U.S. CONSTRUCTION EQUIPMENT EXPORTS DROP 17%

Exports of U.S.-made construction equipment declined 17 percent for the first half of 2015 compared to the first half of 2014, with a total $7.4 billion shipped to global markets.

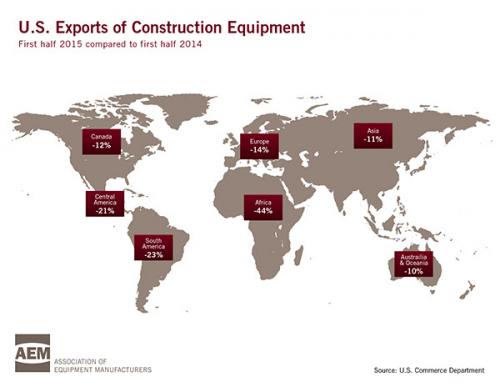

All world regions experienced declines, led by Africa, according to the Association of Equipment Manufacturers (AEM). The AEM equipment manufacturing trade group cited U.S. Department of Commerce data it uses in global market reports for members.

Exports by World Region

January-June 2015 U.S. construction equipment exports by major world regions compared to January-June 2014:

- Canada dropped 12 percent, for a total $3.1 billion

- South America declined 23 percent, for a total $990 million

- Asia decreased 11 percent, for a total $923 million

- Europe dropped 14 percent, for a total $878 million

- Central America fell 21 percent, for a total $748 million

- Australia/Oceania declined 10 percent to $417 million

- Africa decreased 44 percent to $385 million

AEM Market Analysis Overview

AEM’s Benjamin Duyck, director of market intelligence, provides some insights:

The second quarter of 2015 marked the 10th consecutive quarter that U.S. construction equipment exports experienced year over year declines and the 7th consecutive quarter that imports rose. While exports decreased for every major region, the only equipment category we noticed some export growth in were generator sets.

While the U.S. market remains stable overall (there are some areas affected by the lower oil prices), the U.S. trade balance for our industry continues to slump. It is hard to pinpoint the exact cause of this situation, as there are many issues at play here.

First of all, a stronger U.S. dollar is making U.S. manufacturers less competitive.

A second issue is the global deterioration of demand due to cyclical and structural issues. As investment is flowing from the emerging markets back to the developed western nations, demand for construction equipment travels with it.

Exports by Top 10 Countries

The top countries buying the most U.S.-made construction machinery during the first half of 2015 (by dollar volume) were:

- Canada – $3.1 billion, down 12 percent

- Mexico – $602 million, down 22 percent

- Australia – $387 million, down 9 percent

- Chile – $273 million, down 9 percent

- Brazil – $268 million, down 25 percent

- South Africa – $206 million, down 48 percent

- Peru – $192 million, down 31 percent

- Belgium – $147 million, down 30 percent

- China – $140 million, down 26 percent

- Saudi Arabia – $124 million, down 40 percent